Drowning in $80,000 of debt while daydreaming about seeing the Eiffel Tower might sound like a recipe for financial disaster. Three years ago, that was exactly where I stood – buried under student loans and credit card debt that felt insurmountable. Yet somehow, I managed to visit 17 countries while eliminating every penny of that burden. This isn't about inherited wealth or a six-figure tech job; it's about strategic choices that allowed financial freedom and adventure to coexist.

My Debt Reality Check

The moment still feels fresh: sitting at my kitchen table, spreadsheets open, finally adding up every loan, credit card, and outstanding payment. The number hit me like a truck – $79,843 in total debt. About $62,000 was student loans from my master's degree, while the rest was a mix of credit card debt and a personal loan I'd taken for emergency dental work.

My salary at the time? A modest $43,500 working as a content specialist at a marketing firm in Chicago. The math didn't add up for someone who also couldn't shake the travel bug that had bitten me during a college semester abroad.

"You can either pay off debt OR travel, not both," my well-meaning father insisted during Sunday dinner. His advice made logical sense, but something in me refused to accept this either/or proposition.

Breaking Down My Debt Portfolio

Before sharing how I managed this balancing act, let me break down what I was dealing with:

- Federal student loans: $52,000 at 5.8% interest

- Private student loan: $10,000 at 7.2% interest

- Credit card debt: $13,500 across three cards (interest rates from 17.99% to 24.99%)

- Personal loan: $4,343 at 9.5% interest

The minimum payments alone were eating nearly 40% of my take-home pay. Something had to change.

The International Job Strategy

The turning point came during a random lunch with a former classmate who mentioned teaching English abroad. "International schools are always looking for native English speakers with degrees," she said between bites of her sandwich. "And many cover housing and offer tax benefits."

That conversation sparked what became my primary debt-elimination strategy: leveraging geographic arbitrage. After researching international teaching and counseling positions (my background was in psychology), I landed a position at an international school in Bangkok, Thailand.

The financial advantages were immediate:

- Base salary: $41,000 (slightly less than my US job)

- Housing allowance: $12,000 annually (completely covering my rent)

- Foreign earned income exclusion: I qualified to exclude my income from US federal taxes

- Significantly lower cost of living: my daily expenses dropped by approximately 60%

This arrangement created a financial surplus that simply wasn't possible in Chicago. I could maintain a comfortable lifestyle while directing 50-60% of my income toward debt repayment.

The Debt Snowball With a Travel Twist

I adapted Dave Ramsey's debt snowball method with a few modifications. The traditional approach suggests paying minimum payments on all debts while throwing extra money at the smallest balance first. Once that's paid off, you roll that payment into the next smallest debt, creating momentum.

My twist included:

- Tackling highest-interest debt first (the credit cards) rather than smallest balances

- Setting aside a modest "travel fund" of $200 monthly

- Creating "celebration trips" after hitting major debt milestones

The travel fund might seem counterintuitive when fighting debt, but it served two purposes: maintaining my mental health through occasional weekend trips to nearby countries (Vietnam, Cambodia, Malaysia) and preventing the larger "splurge trips" that happen when people feel too restricted.

For example, after paying off my first credit card ($4,200), I used some of my travel fund for a 3-day trip to Hanoi. Total cost: $180 including flights. These mini-adventures kept me motivated without derailing progress.

My Monthly Budget Breakdown in Thailand

Income: $3,416/month (plus housing covered)

- Debt payments: $1,900

- Food: $300

- Transportation: $50

- Utilities/phone: $80

- Travel fund: $200

- Emergency fund: $200

- Miscellaneous: $150

- Remaining: $536 (additional debt payment)

This aggressive approach allowed me to pay off all credit card debt within 9 months.

Side Hustles: The Acceleration Factor

Living abroad created unique side hustle opportunities I hadn't considered before. As a native English speaker with a master's degree, I found myself in high demand for:

- Private English tutoring ($25-35/hour)

- College application essay consulting ($50-75/hour)

- Weekend SAT prep courses ($40/hour)

- Content writing for travel websites ($100-200 per article)

These gigs added approximately $1,000-1,500 monthly to my income, almost all of which went straight to debt payments. The beauty of side hustles in a lower-cost country is that even modest earnings in USD go much further.

Some weeks were exhausting, juggling my full-time position with 10-15 hours of side work. But watching those loan balances drop provided motivation that coffee couldn't match.

How Did I Actually Travel While Paying Debt?

This is the question I get most often. The answer involves several strategies:

- Strategic location: Bangkok served as an ideal hub with low-cost carriers flying throughout Southeast Asia. Weekend trips to Vietnam or Cambodia often cost less than $100 round-trip.

- Travel hacking (lite version): I opened two travel credit cards with significant sign-up bonuses but used them responsibly for regular expenses, paying them off immediately. This funded two larger trips.

- Slow travel: Rather than rushing through countries, I'd spend extended time in one location, often finding affordable monthly rentals through local connections.

- School holidays: International schools typically offer generous holiday schedules. I used these breaks for longer adventures without taking unpaid time off.

- Travel as a side hustle: I began writing travel content for websites, sometimes securing complimentary accommodations or tours in exchange for content creation.

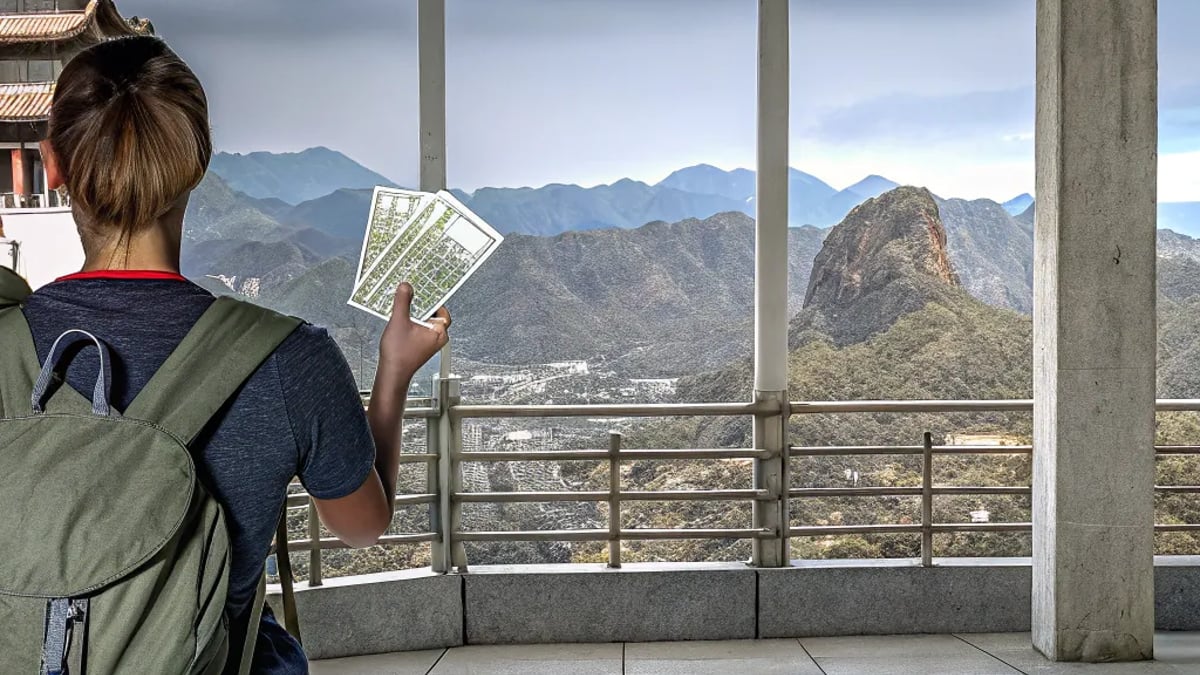

During my three years abroad, I visited Thailand, Vietnam, Cambodia, Malaysia, Singapore, Indonesia, the Philippines, Taiwan, South Korea, Japan, India, Sri Lanka, the UAE, Turkey, Greece, Italy, and France – all while paying down debt.

Was It Worth It? Lessons Learned

Paying off $80,000 while traveling wasn't always glamorous. There were sacrifices:

- I lived in a modest studio apartment while colleagues chose luxury condos

- My wardrobe remained minimal, with few new purchases

- I cooked most meals at home rather than enjoying Bangkok's restaurant scene daily

- Some weekends were dedicated to side hustles rather than exploration

- I maintained a strict "no souvenirs" policy (photos only!)

But the freedom of watching those final payments go through while sitting in a café in Paris? Absolutely priceless.

The Most Important Things I Learned

- Geographic arbitrage is powerful. Your earning potential compared to local cost of living creates financial possibilities that aren't available everywhere.

- Debt payoff doesn't require complete austerity. Strategic spending on experiences that matter while cutting ruthlessly in areas that don't was key to staying motivated.

- International experience creates unexpected income opportunities. Skills that are common in your home country may be premium services elsewhere.

- Consistency trumps perfection. Some months I put less toward debt due to a special travel opportunity. The key was returning to the plan rather than abandoning it.

- Financial freedom and experiences can coexist. The either/or mentality is often false – creativity and flexibility can create a third path.

Is This Approach Right for You?

This strategy isn't for everyone. It worked for me because:

- I had no dependents or family obligations requiring me to stay in the US

- My debt, while substantial, was mostly federal student loans with reasonable interest rates

- I had marketable skills that transferred well to an international setting

- I was willing to make significant lifestyle changes

If you're considering a similar path, thoroughly research visa requirements, international tax implications, and employment opportunities in your field. The International Schools Review provides insights into teaching opportunities worldwide, while Nomad List offers cost of living comparisons for digital nomads.

What About Those Who Can't Move Abroad?

Not everyone can relocate internationally. Alternative approaches might include:

- Relocating to a lower-cost area within your country

- Negotiating remote work arrangements to enable geographic flexibility

- Using travel rewards programs strategically while focusing primarily on debt

- Creating "debt-cation" goals – specific travel rewards for hitting major debt milestones

The core principle remains: finding ways to increase the gap between income and expenses while maintaining quality of life elements that matter most to you.

Disclaimer: This article reflects my personal experience and is shared for informational purposes only. It should not be considered financial advice. Everyone's financial situation is unique, and what worked in my circumstances may not be appropriate for others. Always consult with a qualified financial professional before making significant financial decisions.

Tags

About Elliot J. Branson the Author

Elliot J. Branson is a seasoned financial analyst with over two decades of experience guiding individuals through their investment journeys. His expertise lies in creating personalized strategies to help investors navigate volatile markets and achieve long-term financial success.

Recommended Articles

This Walker Design Is Changing How Seniors Move

Discover how innovative walker designs empower seniors by enhancing mobility and independence with lightweight, ergonomic features and modern aesthetics.

Longevity Secrets: SUVs That Refuse to Quit

Discover the secrets to finding SUVs that stand the test of time with durability and reliability for long-lasting performance.

5 Short Drama Apps That Will Keep You Hooked With Just One Episode

Discover 5 engaging short drama apps that keep you hooked from the first episode, offering quick entertainment at your fingertips.

5 Workout Apps That Will Transform Your Routine—No Gym Required

Discover 5 transformative workout apps that elevate your fitness routine without needing a gym. Stay fit anywhere, any time!

2026 Ford F-150: Tougher and Smarter Than Ever

Discover the 2026 Ford F-150, featuring enhanced performance, smart technology, and a focus on safety. The toughest truck is smarter than ever!