Mechanics Recommend These 6 Cars That Rarely Need Repairs

Discover the top 6 recommended cars that rarely need repairs, ensuring reliability and peace of mind for every driver.

Personal accounts of various investment experiences and the outcomes achieved

Discover the 2026 Honda Civic's new features, hybrid options, and technology enhancements for an improved driving experience.

Discover why the 2026 Nissan Z is capturing the hearts of automotive enthusiasts with its stunning design and powerful performance.

Explore the 2026 Nissan Navara, where rugged power meets modern tech. Discover its bold design, performance specs, and smart features today!

Discover how Medicare's new 2026 drug discounts will impact seniors and prescription costs under the Drug Price Negotiation Program.

Discover the 10 drugs that will see major price drops in 2026 through Medicare's new pricing initiative aimed at helping seniors afford essential medications.

Learn how to effectively plan a basic A6C strategy with six key elements for aligning your organization's long-term goals.

Discover the most damaging habit in your baby's first year that impacts emotional safety, as revealed by MRI scans. Learn how to improve your parenting.

Learn to raise resilient children by avoiding 10 common parenting mistakes that hinder their emotional growth and mental strength.

Discover effective tips to lower PSA levels naturally. Learn how diet, exercise, and lifestyle changes can promote prostate health.

Explore how estrogen blockers impact hormonal balance, bone health, and overall well-being for both men and women. Learn about their uses and side effects.

Explore walking routines recommended by cardiologists to manage AFib symptoms and enhance heart health through simple, effective exercises.

Learn how to detect macular degeneration early to preserve vision. Key symptoms and importance of regular eye exams are discussed.

Discover moisturizers recommended by dermatologists for mature skin, focusing on hydration and support for a youthful glow.

Explore why women over 70 are choosing stylish and comfortable eyewear in 2026, blending fashion with practicality for the perfect choice.

Explore the latest in comfortable and stylish eyeglass frames for 2026, blending aesthetics with advanced materials for a perfect fit.

Learn about police impound engines in 2026, auction processes, and how to find quality parts for automotive needs while saving money.

Learn when to sue for medical malpractice. Understand the criteria, signs, and steps needed to pursue a claim effectively.

Discover how estrogen blockers function in healthcare, particularly in cancer treatment and hormone therapy for gender transition.

Discover how to detect leaky heart valve symptoms early. Learn about causes, effective management, and important signs to watch for.

Transform your winter yard with a heated bird bath that attracts birds, enhances your garden, and provides essential support for local wildlife.

Discover how drone footage is revolutionizing forest research, enhancing ecosystem insights, and offering unique perspectives on environmental conservation.

Explore five over-the-counter sleep aids recommended by doctors, their benefits, risks, and tips for safe use to improve your sleep quality.

Discover how seniors are opting for natural sleep aids over prescription pills for better sleep and improved health.

Explore the potential of a new pill that could replace blood thinners, improving treatment options for millions with clotting disorders.

Discover four simple breakfast fixes to help lower high creatinine levels and support kidney health through dietary adjustments.

Discover how olive oil and coconut oil can relieve joint stiffness and promote better joint health naturally.

Relieve hip pain in just 30 seconds with a simple stretch targeting key muscles for quick discomfort relief and improved flexibility.

Discover four simple exercises to improve your walking posture. Learn how to walk tall and straight to reduce pain and enhance mobility.

Discover essential tips on how to discuss the new diabetes drug with your doctor. Ensure effective communication for better diabetes management.

Explore five OTC sleep aids that even doctors trust for managing insomnia and restless nights, along with their benefits and considerations.

Discover 9 small moves to boost your balance and stability for better health and confidence in daily activities.

Discover breakthrough tinnitus treatments like bimodal neuromodulation and customized sound therapy that promise relief for those affected by ear ringing.

Discover five vintage cookbooks that may be worth big money and learn how to assess their value and sell them effectively.

Struggling to sleep? Learn about the best OTC sleep aids from your pharmacist to find the right one for your needs and sleep soundly.

Discover how extra virgin olive oil and essential oils can support joint health and relieve discomfort in your daily life.

Discover the striking color options for the 2025 Hyundai Tucson, from bold shades to classic tones, making every drive a personal statement.

Discover CMS' 2025 changes affecting 64 drugs under new inflation rules. Learn about cost savings and what it means for Medicare enrollees.

Understand atrial fibrillation (AFib) symptoms, risks, and treatments with insights from cardiologists to help you manage your heart health effectively.

Explore the latest advancements in diabetes treatment, including immunotherapy and personalized approaches for better management and outcomes.

Discover hidden antiques in your attic that could be worth thousands today. Uncover the value of vintage toys, coins, and more!

Discover 10 genius storage ideas to maximize space in your home and create a feeling of openness with smart design solutions.

Discover the perfect wedding guest dresses for every occasion! Explore styles, colors, and tips to shine while complementing the bride.

Discover the vibrant color lineup of the iPhone 17, where aesthetics meet technology. Explore how colors impact user emotions and choices.

Discover how modern cataract surgery is enhancing vision for seniors, improving clarity, independence, and overall quality of life.

Discover the growing demand for wholesale Christmas decorations and how retailers can benefit from bulk purchasing this holiday season.

Discover how simple kitchen tools make cooking fun and creative, transforming the chore into a joyful culinary adventure!

Discover the 2025 Nissan Murano, featuring modern design, enhanced performance, and advanced technology for a luxurious SUV experience.

Discover the 2025 Toyota Camry's sleek design, advanced performance, and innovative technology that set it apart in the competitive sedan market.

Discover the stylish and spacious 2026 Toyota Kluger SUV, perfect for families with advanced tech features and exceptional performance options.

Discover the top handbag trends of 2025, featuring chic styles that combine fashion and functionality for every occasion.

Discover how magnesium can enhance sleep quality and relieve insomnia in 2025 with natural solutions.

Discover the ultimate gifts for everyone this season! From tech gadgets to personalized items, find the perfect surprises for your loved ones.

Discover stylish pant alternatives to jeans for women over 40, focusing on comfort, versatility, and current fashion trends.

Explore timeless fashion styles that rekindle seniors' love for life, blending nostalgia with modern trends for confident self-expression.

Discover effective remedies for itchy skin shared by boomers, including natural ingredients and trusted OTC solutions for relief.

Discover essential phones with one-touch emergency features seniors love for safety and convenience. Stay connected easily during emergencies.

Discover the cars seniors are proud of for their reliability and long-lasting performance, from Toyota to Subaru. Find the best options for comfortable driving.

Explore the cars Baby Boomers trust for their durability and reliability, celebrating timeless models with lasting appeal.

Revitalize your wardrobe with timeless pieces! Discover why rotation matters and how to effectively refresh your closet for a stylish lifestyle.

Discover stunning wedding outfits for mature guests that blend elegance and comfort, allowing you to celebrate in style!

The cinema industry in 2025 showcases significant financial shifts, with major films like "Quantum Horizon" and "Daybreak Chronicles" driving both theatrical and streaming revenue, impacting studio stocks and investment opportunities. Emerging financial trends include international partnerships and changing compensation structures, suggesting new market strategies for investors while highlighting entertainment's role in influencing broader economic and consumer behaviors.

The 2025 Hyundai Palisade, with its refined luxury features and expanded powertrain options, positions itself as a strong contender in the premium SUV market by offering upscale design and technology innovations, while competitive financing and warranty coverage enhance its value proposition against rivals like the Kia Telluride and Toyota Highlander.

Smart glucose devices are revolutionizing health monitoring by offering continuous, real-time tracking of glucose levels, reducing healthcare costs, and integrating into a comprehensive ecosystem of devices, with expected advancements by 2025 including smaller sensors and predictive algorithms; consumers should consider privacy, costs, and device compatibility before investing, as these technologies increasingly influence both healthcare management and financial planning.

Your change jar might contain valuable coins worth more than their face value, with key factors like rarity, condition, mint errors, historical significance, and metal content determining their value. Look for specific dates on pennies, nickels, dimes, and quarters and focus on characteristics such as mint errors and silver content to identify coins potentially worth hundreds or even thousands of dollars, with beginner tips including sorting by denomination, checking dates, and joining online communities for guidance.

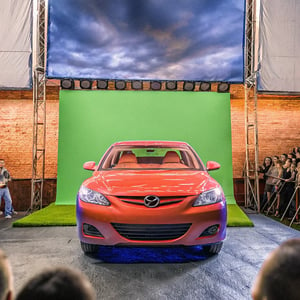

Mazda plans to launch a new, bold vehicle color for its 2025 lineup, developed over three years to offer a sophisticated, vibrant hue that changes under different lighting conditions and features advanced paint technology. This color, part of Mazda's broader design innovation, will be unveiled at the upcoming International Auto Show and is expected to be available across multiple vehicle models, offering a unique selling point that could enhance both sales and resale value.

Discover potential treasures in your change as certain rare coins, like pre-1965 silver coins, wheat pennies, and error coins, can be worth significantly more than their face value due to factors like rarity, condition, and historical significance; for accurate valuation, seek professional appraisal and avoid cleaning the coins.

The bold new iPhone in yellow represents Apple's latest color innovation, serving as a statement piece that evokes optimism and energy, while potentially offering higher resale value and intangible enjoyment benefits; despite price parity with other models, financial considerations include possible higher costs for clear cases to showcase the vibrant color.

Investors and consumers may find Apple's rumored 2025 pink iPhone an intriguing financial consideration, as limited edition colors can create scarcity, driving demand and potentially increasing resale values. For consumers, the decision involves weighing the premium paid for aesthetic appeal against potential resale benefits, while investors should consider how Apple's color strategy reflects broader market positioning and product cycle strategy.

Apple's rumored iPhone in teal for 2025 is a strategic move to boost sales and revenue, similar to previous color introductions like Sierra Blue, which contributed to a 19% revenue increase; this limited edition color is expected to capitalize on anticipated consumer spending rebounds and may increase revenue by $3-5 billion if past trends continue, despite a slight rise in production costs.

Apple's introduction of the new pink iPhone is a strategic financial move aimed at boosting sales by leveraging color as a purchase incentive, typically increasing launch quarter sales by 3-7% and enhancing resale value. This color strategy reflects Apple's approach to maintaining brand excitement and sales momentum between major iPhone feature upgrades, benefiting both direct iPhone sales and related accessory markets without altering the price parity.

Apple's new limited edition teal iPhone, expected to launch in 2025, is part of a strategic move leveraging color psychology to enhance premium pricing, projected to add $800 million to $1.2 billion in revenue in its first quarter. For consumers, limited editions tend to depreciate less, making them financially prudent despite higher initial costs, while for investors, the release of unique iPhone colors historically benefits supplier stocks, highlighting Apple's ability to maintain high profit margins by creating premium, emotionally resonant experiences.

Apple's anticipated 2025 ultramarine iPhone is expected to boost sales by 3-7%, potentially driving billions in additional revenue due to its unique appeal as a fashion statement and significant marketing strategy, which could influence short-term stock price movements and provide investment opportunities coinciding with product announcements.

The gold necklace design trends for 2025 focus on innovation and sustainability, with designers creating unique, personalized pendants using recycled or ethically sourced materials, presenting new opportunities for environmentally conscious, yet luxurious purchases. From an investment perspective, prioritize high gold purity and timeless designs from reputable designers as they typically retain long-term value; however, gold jewelry should mainly be viewed as a aesthetic purchase rather than a financial investment.

After moving from the US to Germany, the author faced unexpected financial challenges such as higher rental deposits, navigating a new banking system with no local credit history, and managing dual-country tax obligations. Through strategic planning, building local financial relationships, and seeking specialized tax advice, they successfully established financial stability abroad. Key lessons include the importance of understanding the destination country's financial system, budgeting for higher initial expenses, and maintaining financial ties to one's home country.

Starting with just $100 a month in investments can significantly grow your wealth over time through the power of compound interest, despite initial hesitations about its impact. Consistent, small investments help develop good financial habits, reduce anxiety, and ultimately lead to substantial long-term growth, especially when utilizing platforms without minimum investment requirements and focusing on diversified, low-fee index funds.

The author reflects on their first year investing in index funds, highlighting lessons learned such as the benefits of dollar-cost averaging, the value of setting up automatic investments, and the pitfalls of checking portfolios too frequently or chasing performance. They recommend starting with target date funds for simplicity, clarifying investment goals for better strategy alignment, and focusing on increasing contributions over seeking high returns.

The author transitioned from a beginner to a confident cryptocurrency trader over three years by starting with small investments, learning from expensive rookie mistakes, and developing a personal trading strategy focused on risk management and emotional resilience. Key takeaways include the importance of starting with amounts you can afford to lose, conducting thorough research, using a disciplined approach to trading, avoiding FOMO, and maintaining a balance between staying informed and avoiding information overload.

In their first year of stock investing, the author learned valuable lessons, including the importance of starting early despite market fears, the risks of an undiversified portfolio, managing emotional reactions to market volatility, and the significance of tax-efficient investing. They advise new investors to begin with small amounts, prioritize diversification, anticipate emotional responses, consider tax implications, and continuously educate themselves on investing while remaining open to professional advice.

Turning $5,000 into $20,000 over seven years, the author credits a disciplined investment approach using low-fee index funds and emphasizes the importance of consistency, patience, and tax-efficient strategies like automatic contributions and reinvesting dividends. This straightforward strategy, which can be accessible to others with discipline, highlights the long-term benefits of compounding growth and avoiding emotional reactions to market fluctuations.

The article outlines a personal journey of building a dividend portfolio from scratch, emphasizing the importance of dividend investing for generating consistent passive income, choosing diversified and financially stable companies, and reinvesting dividends for compounding growth. Key lessons include avoiding high-yield pitfalls, focusing on dividend growth over immediate yields, and maintaining a disciplined, systematic approach to stock selection and portfolio management.

The article outlines a personal journey into real estate investing on a budget, emphasizing the strategic purchase of a $89,000 property in Toledo, Ohio with a $3,115 down payment, using an FHA loan via house hacking to overcome financial hurdles. It highlights the importance of creative financing, strategic renovations, and understanding ongoing costs and the time commitment involved in property management, ultimately achieving a 9.3% cash-on-cash return in the first year, while offering advice on necessary planning and considerations for aspiring investors.