That sinking feeling in your stomach when you check your bank balance and see a measly $10 staring back at you—with payday still days away. I've been there more times than I care to admit, and if you're reading this, chances are you have too. The constant juggling act between bills, groceries, and unexpected expenses can leave even the most financially responsible person scraping by at month's end.

The Reality of Living Paycheck to Paycheck

Last month, I found myself in this exact situation. After paying rent, utilities, and my car payment, I was left with just $10.27 to stretch across three days until my next paycheck arrived. This wasn't due to frivolous spending or poor planning—it was simply the reality of living in a city where housing costs consume nearly 50% of my income.

According to a Reddit discussion I stumbled upon, I'm not alone. Many Americans earning around $30,000 annually describe their cities as "black holes for income" where housing costs are disproportionately high compared to wages. One commenter mentioned, "The housing is crazy expensive and I know what jobs pay here and a lot of people are just barely scraping by."

Healthcare workers at Compass Health recently picketed for better wages, with one worker, Erick Bipat, expressing the common struggle: "having $10 left in our bank accounts two days before payday." These aren't people making poor choices—they're hardworking individuals caught in an economic squeeze.

How I Survived My $10 Days

When I realized I had only $10 to last until payday, here's what I did:

- Took inventory of my pantry and planned meals using what I already had

- Used $5 for a half-gallon of milk and a loaf of bread

- Kept $5 as emergency gas money

- Avoided all social invitations that would cost money

- Brought lunch from home instead of buying food at work

The experience was stressful but enlightening. I discovered creative meal combinations I wouldn't have tried otherwise (rice with canned vegetables and the last bit of soy sauce makes a surprisingly decent dinner). I also realized how much my casual spending on coffee and convenience items had been adding up.

The Payday Loan Trap I Narrowly Avoided

During those three days, I was tempted by payday loan advertisements promising quick cash. The appeal is obvious when you're staring at an empty refrigerator or need gas to get to work. However, I'd seen firsthand how these loans can create a devastating cycle.

A friend of mine shared their experience on r/personalfinance: "I am getting buried in a horrible cycle of payday loans... every payday I have $10 left over, or sometimes my account goes overdrawn immediately." What started as a one-time emergency solution had snowballed into a financial nightmare with interest rates exceeding 400% annually.

Instead of taking this route, I chose to:

- Call my utility company and negotiate a payment extension

- Ask a friend if I could carpool for those few days

- Eat simple meals from my pantry staples

Breaking the Cycle: What Changed After My $10 Wake-Up Call

This experience forced me to take a hard look at my financial situation. While my income constraints were real, there were still changes I could make:

Creating a Bare-Bones Emergency Fund

Taking inspiration from Jim Carrey's famous story of writing himself a $10 million check before he had the money, I decided to start visualizing financial security. I began by setting aside just $5 from each paycheck—an amount so small I wouldn't miss it, but would gradually build a buffer for these tight moments.

Finding Additional Income Streams

I started looking for side gigs that worked with my schedule. This isn't about "hustle culture" or working myself to exhaustion—it's about finding practical solutions within my reality. For me, this meant occasional weekend pet-sitting and selling items I no longer needed.

Community Resources I Discovered

During my research, I found several community resources I hadn't known about:

- Local food pantries that don't require proof of income

- Community meal programs

- Utility assistance programs

When $10 Is All You Have: Practical Advice

If you find yourself in this situation, here are some practical steps:

- Prioritize absolute necessities - food, transportation to work, and medications

- Call service providers before bills are due to explain your situation and request extensions

- Look for no-cost food resources in your community

- Avoid payday loans at all costs—they'll make your situation worse in the long run

- Plan ultra-simple meals using affordable staples like rice, beans, eggs, and oatmeal

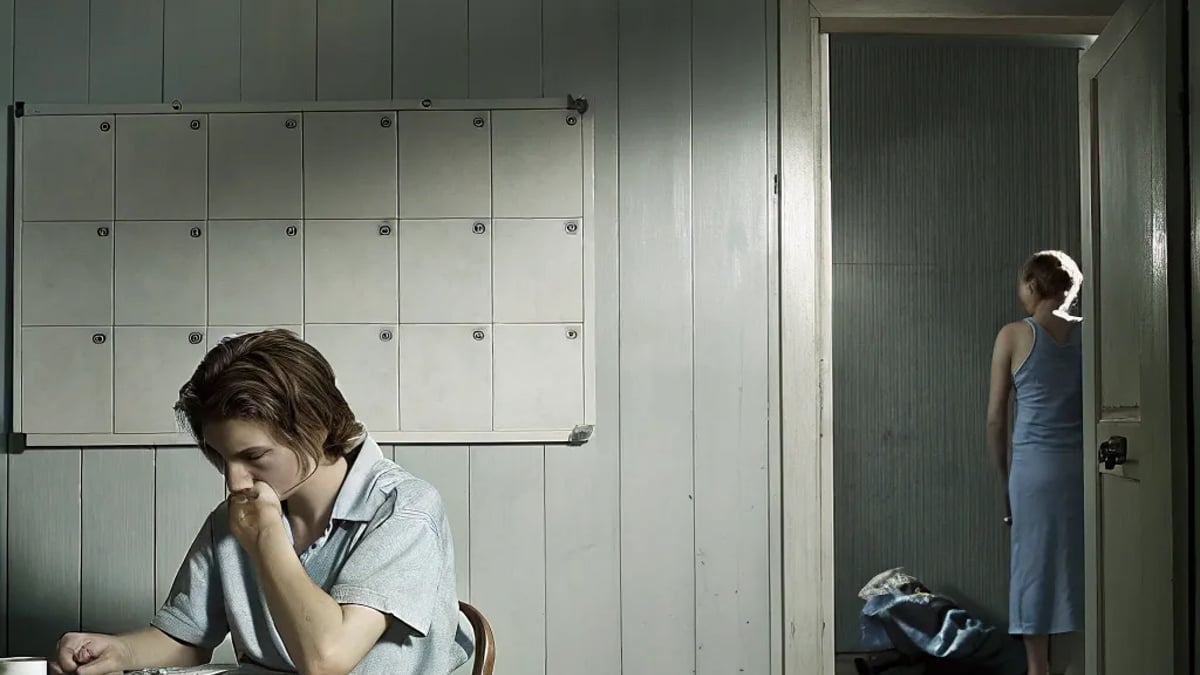

The Emotional Side of Financial Struggle

Perhaps the hardest part of having just $10 left is the emotional toll. There's shame, anxiety, and the constant mental calculations of how to stretch every dollar. It's exhausting.

What helped me was realizing this situation doesn't define my worth or abilities. Financial struggles happen to millions of Americans—many working full-time in essential jobs. The problem often isn't personal spending habits but rather systemic issues like housing costs outpacing wage growth.

Disclaimer: This article is based on personal experience and is for informational purposes only. It is not intended as financial advice. Financial situations vary, and you should consult with a financial professional for advice specific to your circumstances.

Tags

About Elena Schwarzkopf the Author

Elena Schwarzkopf is a seasoned finance writer with over a decade of experience in crafting actionable budgeting tips that help individuals regain control over their finances. Known for her practical approach, Elena's insights empower readers to transform their financial habits and achieve their savings goals.

Recommended Articles

How to Detect Macular Degeneration Early

Learn to detect macular degeneration early through eye exams and understanding symptoms, ensuring proactive eye health management.

Rent-to-Own Tow Trucks: What to Know in 2026

Explore rent-to-own tow trucks in 2026, offering flexibility for operators to gradually gain ownership while managing costs effectively.

How to Spot a Valuable Toy Before Selling It at a Garage Sale

Learn how to identify valuable toys to sell at garage sales, maximizing profit while decluttering your home. Find out what buyers are looking for!

5 Old Household Items That Are Suddenly Worth Money

Discover five old household items that could be worth a lot of money today, from vintage typewriters to collectible toys and more.

The Smart Rollator That’s Redefining Independence for Seniors

Smart rollators are revolutionizing senior mobility by integrating advanced technology, such as intelligent braking systems, GPS for location tracking, and health monitoring features, which improve safety and reduce healthcare costs through fall prevention. These devices, despite their higher upfront cost, offer long-term financial benefits by delaying the need for costly home care, and some insurance plans may cover the associated expenses.