Keeping track of my finances has been a game-changer for my financial health. Last month, I decided to get serious about understanding where my money goes and document the journey. This isn't just about pinching pennies—it's about gaining control and making intentional choices with my hard-earned cash.

How I Set Up My Budget Tracking System

When I first decided to track my spending, I felt overwhelmed by the options. Should I use an app? A spreadsheet? Good old-fashioned pen and paper? After trying a few methods, I settled on a hybrid approach that works for my lifestyle.

I started with a simple Excel spreadsheet—nothing fancy, just columns for date, category, amount, and notes. For on-the-go tracking, I use the Notes app on my phone to jot down expenses when I'm out, then transfer them to my spreadsheet every few days. This might sound tedious, but the manual entry actually helps me stay aware of my spending in a way automated tools don't.

"Tracking your expenses is like having a conversation with your money," as financial educator Rachel Cruze often says. And she's right—my spending patterns started telling me a story about my priorities and habits.

Categories That Made Sense for My Life

Rather than using standard budget categories, I created custom ones that reflect my actual lifestyle:

- Essentials (rent, utilities, groceries)

- Work-related (commuting, lunches, professional development)

- Health & wellness (gym, therapy, medications)

- Social life (restaurants, entertainment, gifts)

- Future me (savings, investments)

- Subscriptions (streaming services, memberships)

- Unexpected expenses (car repairs, medical bills)

This personalization made tracking feel relevant rather than like a chore imposed by some financial guru who doesn't understand my life.

What I Discovered About My Spending Habits

The first revelation hit me about two weeks in: I was spending $14.75 on coffee shop visits nearly every workday. That's roughly $295 a month just on fancy coffee! I'm not saying I needed to cut this completely—coffee brings me joy—but seeing the total made me decide to bring coffee from home twice a week, saving about $118 monthly.

Another surprise was my "phantom spending"—small purchases I made without thinking. A $3.99 app here, a $7.50 convenience store purchase there. These seemingly insignificant amounts added up to nearly $200 last month!

I also noticed emotional spending patterns. After stressful workdays (especially Tuesdays, for some reason), I was more likely to order takeout or buy something online. This awareness alone helped me develop better coping mechanisms—like going for a walk instead of opening the DoorDash app.

The Unexpected Benefits of Tracking

Beyond the obvious financial insights, keeping this budget journal had other benefits:

- I sleep better knowing exactly where I stand financially

- Shopping decisions became easier with clear priorities

- My anxiety about money decreased significantly

- I found it easier to say "no" to impulse purchases

- Conversations with my partner about money became more productive

Where Did My Money Actually Go Last Month?

Here's the real talk—my actual spending breakdown from last month:

| Category | Planned | Actual | Difference |

|---|---|---|---|

| Housing | $1,450 | $1,450 | $0 |

| Utilities | $175 | $193.42 | +$18.42 |

| Groceries | $400 | $462.18 | +$62.18 |

| Dining out | $200 | $287.35 | +$87.35 |

| Transportation | $150 | $132.50 | -$17.50 |

| Entertainment | $100 | $145.68 | +$45.68 |

| Shopping | $150 | $237.89 | +$87.89 |

| Savings | $500 | $300 | -$200 |

| Miscellaneous | $100 | $168.75 | +$68.75 |

I overspent in several categories, particularly dining out and shopping. The hardest pill to swallow was that I only managed to save $300 of my targeted $500. This wasn't great, but having the data helped me make adjustments for the following month rather than continuing blindly.

How Do I Actually Stick to My Budget?

This is the million-dollar question I see everywhere, including a popular thread on Reddit's r/MoneyDiariesACTIVE. After trial and error, here's what's working for me:

- Weekly check-ins: Sunday evenings, I review my spending and adjust for the coming week. This frequent touch base keeps me from going too far off track.

- Cash envelopes for problem categories: For dining out and entertainment—my weakness areas—I've switched to using cash. When it's gone, it's gone.

- 24-hour rule: For non-essential purchases over $50, I wait 24 hours before buying. This has prevented countless impulse buys.

- Accountability partner: My friend Sarah and I text each other our weekly spending summaries. The gentle social pressure helps tremendously.

- Celebration of wins: When I stay under budget in a category, I transfer the difference to my "fun fund" rather than just absorbing it elsewhere.

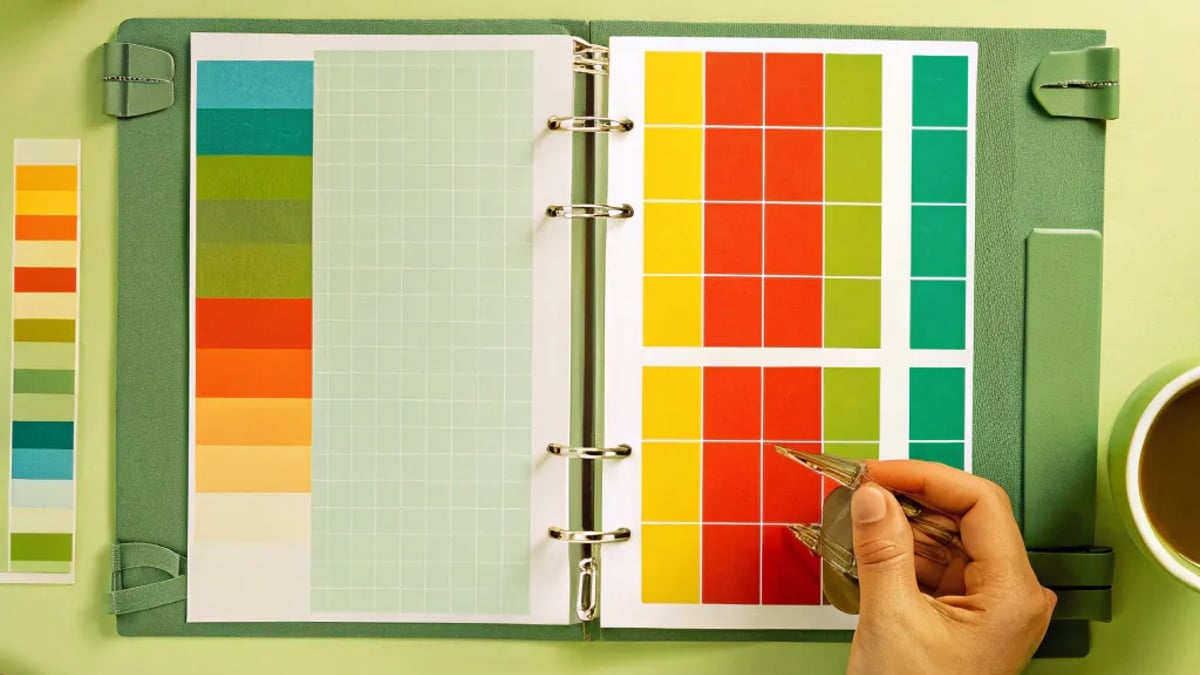

One Reddit user suggested: "I use a journal with a tracker where I color in boxes for each day I don't spend money on non-essentials. Seeing the visual progress keeps me motivated." I've adapted this idea with a simple calendar where I mark "no-spend days" with a star.

What About Saving? My Approach to Building Wealth

Tracking expenses is only half the equation—the other half is intentionally growing wealth. Last month, I managed to:

- Contribute $200 to my emergency fund (now at $3,250)

- Add $100 to my vacation savings (target: $1,500 by July)

- Maintain my automatic 6% contribution to my employer's 401(k)

I'm not where I want to be yet with savings, but the transparency of my budget journal helps me make better decisions. As Bank of America's Better Money Habits points out, "Tracking and categorizing your expenses can help you determine what you are spending the most money on and where it might be easiest to save."

The No-Spend Challenge Experiment

Inspired by a PNC Insights article, I tried a mini no-spend challenge for one week. The rules were simple: no spending on non-essentials for 7 days. I still paid bills and bought groceries but eliminated dining out, entertainment, and shopping.

It was tough (especially when friends invited me out), but I saved $137 that week! More importantly, it reset my perspective on needs versus wants. I'm planning to do a no-spend weekend twice a month going forward.

How Has Budget Tracking Changed My Financial Mindset?

The most significant shift hasn't been in my bank account (though that's improved too)—it's been in my relationship with money. Before tracking, money was this abstract thing that came and went mysteriously. Now, it's a tool I direct intentionally.

I've stopped thinking in terms of "I can't afford that" and started thinking "Is that worth the trade-off?" This subtle shift puts me in control rather than feeling deprived.

Using the MoneyHelper budget planner helped me recognize that "It breaks down where you're spending your money, giving you an idea of where you might be able to make savings and cut costs." This insight helped me prioritize expenses that bring real value to my life.

What's Next in My Budgeting Journey?

As I continue this budget journaling process, I'm setting these goals:

- Increase my emergency fund to cover 6 months of expenses

- Reduce my "convenience spending" by 25%

- Try different tracking methods to find what's sustainable long-term

- Learn more about investing beyond my 401(k)

One approach I'm considering comes from a Reddit thread where a user mentioned: "I log all my spending in a table in an Excel spreadsheet every night. Then I have pivot tables showing how much I've spent each day, each month..." This level of analysis might help me identify even more patterns.

Budgeting isn't a one-size-fits-all process. My journey is unique to my income, goals, and lifestyle—and yours will be too. The important thing is starting somewhere and refining as you go.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Financial situations vary widely, and what works for one person may not work for another. Consider consulting with a financial professional for advice tailored to your specific circumstances.

Tags

About Elliot J. Branson the Author

Elliot J. Branson is a seasoned financial analyst with over two decades of experience guiding individuals through their investment journeys. His expertise lies in creating personalized strategies to help investors navigate volatile markets and achieve long-term financial success.

Recommended Articles

Home Loan Programs for Lower Credit Scores

Discover how home loan programs tailored for lower credit scores help you realize your dream of homeownership. Explore FHA, VA, and USDA options today.

Comparing Medicare Advantage Plans

Explore our comprehensive guide to comparing Medicare Advantage plans, focusing on coverage options, costs, and provider networks.

Where to Find Public Car Auctions Near You

Discover how to find public car auctions near you and learn tips for a successful bidding experience on used vehicles.

Evaluating Medicare Advantage Plan Options

Learn how to evaluate Medicare Advantage Plans to make informed decisions regarding your healthcare coverage and choose the best fit for your needs.

Understanding Apartment Costs and Lease Terms

Understand apartment rental costs and lease terms to make informed decisions for a successful rental experience. Navigate expenses and legal frameworks easily.